Fintech

Mobile Banking App - Budgeting Feature

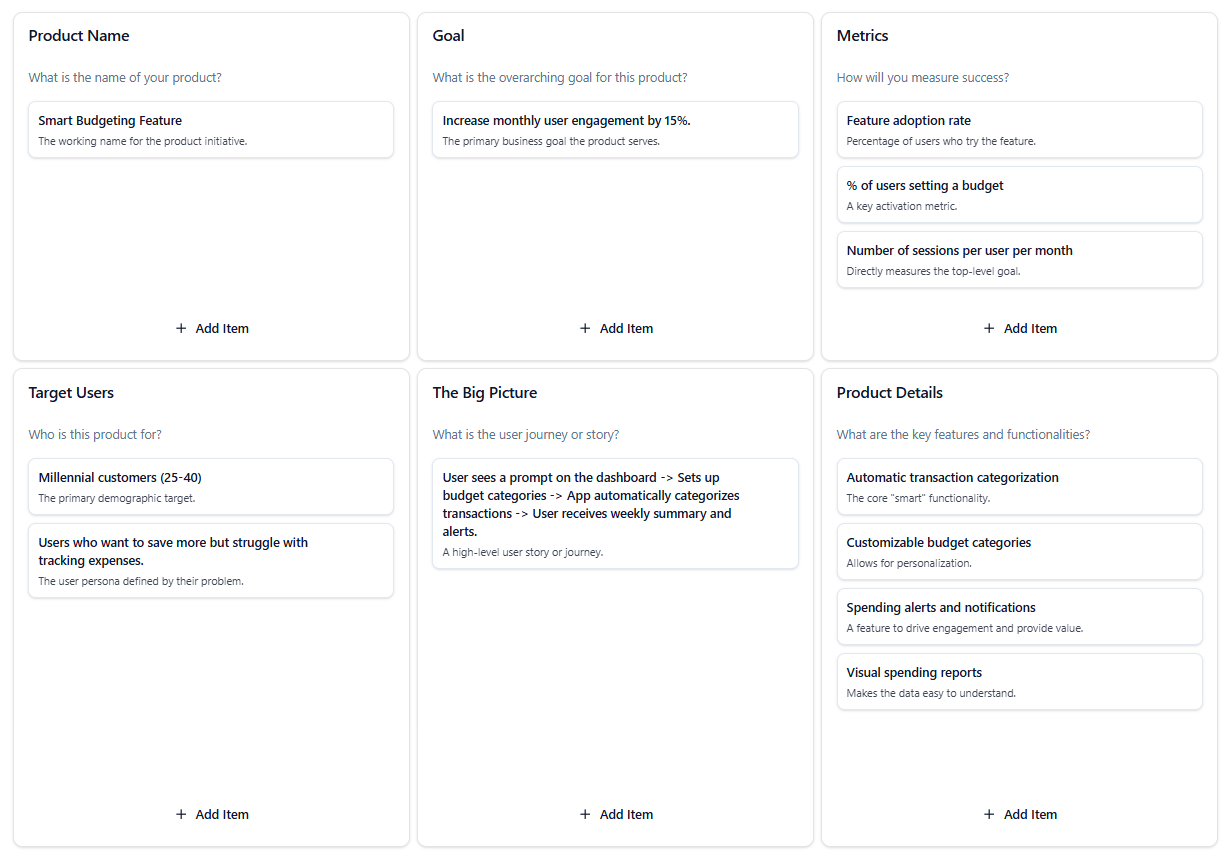

A Product Canvas for a new personal budgeting feature within an existing mobile banking app.

Analysis & Interpretation

Background

This Product Canvas outlines a new ‘Smart Budgeting Feature’ for an existing mobile banking app. The goal is to move beyond basic transaction history and provide proactive financial wellness tools, thereby increasing user engagement and loyalty.

Key Strategic Insights

- Goal-Metric Alignment: The ‘Goal’ (Increase monthly engagement by 15%) is directly and logically measured by the chosen ‘Metrics’ (‘Feature adoption rate’, ‘% of users setting a budget’, ‘sessions per user’). This creates a clear line of sight between the product’s purpose and its success measurement.

- User-Centric Big Picture: The ‘Big Picture’ section tells a clear user story, starting from a prompt and ending with a tangible benefit (‘receives weekly summary and alerts’). This user-centered narrative ensures the features in ‘Product Details’ are not just a list, but components of a cohesive experience.

- Feature Completeness: The ‘Product Details’ cover the full loop of a budgeting feature: automated input (‘categorization’), user control (‘customizable categories’), proactive value (‘alerts’), and feedback (‘reports’). This indicates a well-rounded initial concept.

Strategic Summary

This is a strong, well-defined product canvas for a new feature. The strategy is clear: drive engagement by providing a valuable, user-friendly tool. The riskiest assumption is that the ‘Automatic transaction categorization’ will be accurate enough to be helpful rather than frustrating. The immediate next step should be to prototype and test the quality of this core technology before building out the full feature set.

How This Was Built

This canvas was developed to show how product ideas can be shaped, structured, and validated using the AI-driven features of our tool.

AI Ideation for Product Goals

The AI Brainstorm Tool helped define key objectives and user segments, generating ideas for the User Needs and Product Features sections.

Visual Mapping with Colors and Tags

Colors distinguished between customer-facing features and internal enablers, while tags were used to connect value propositions to specific user goals.

AI Review for Alignment

After completing the layout, the AI Evaluation feature analyzed the consistency between user needs and proposed solutions, highlighting where adjustments were needed.

Bring This Example to Life

Open this Product Canvas in the app to refine your product vision, explore user-centered ideas, and see how AI can guide every step from concept to clarity.