Finance & Banking

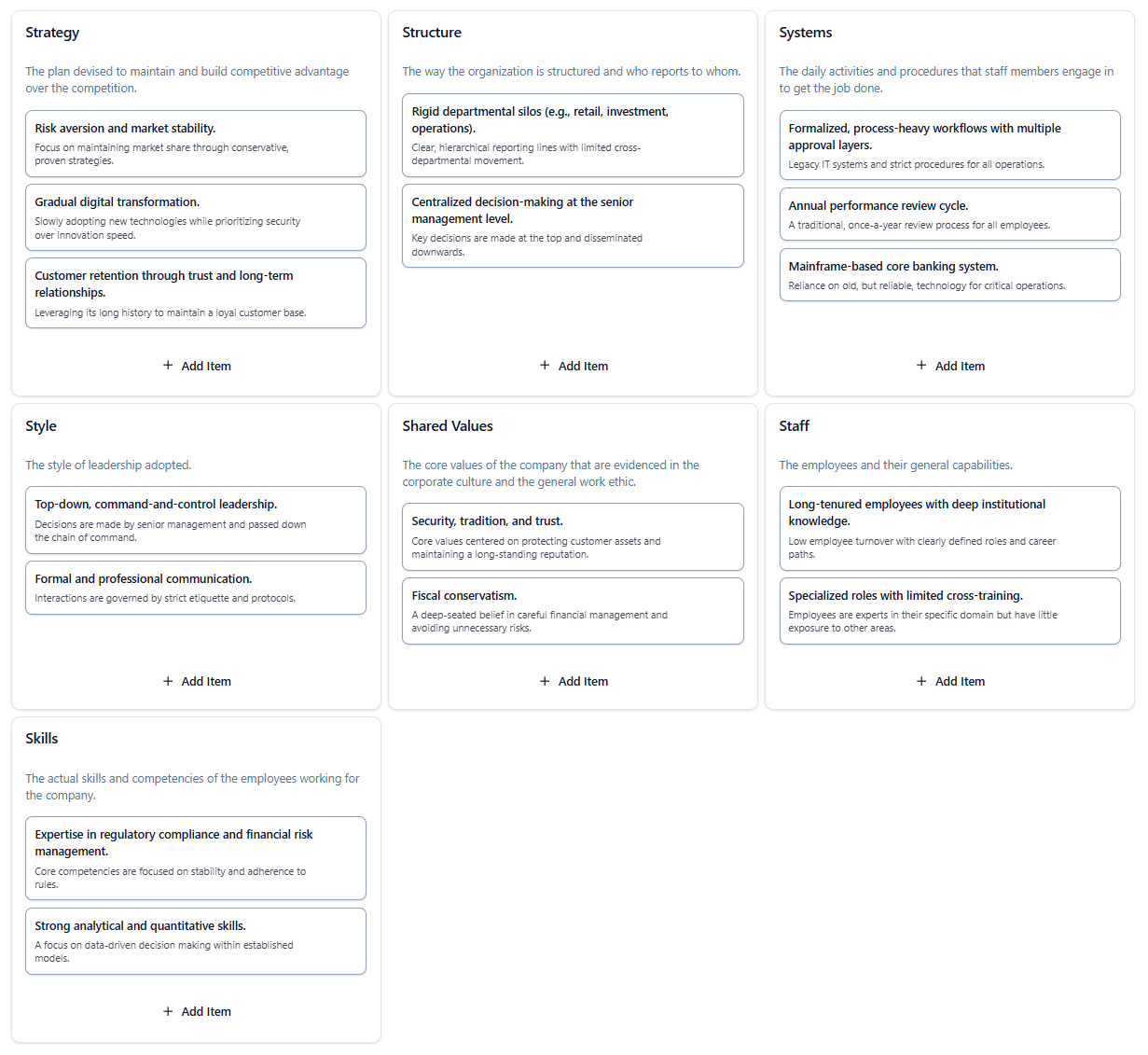

A Traditional, Hierarchical Bank

An analysis of a traditional, hierarchical bank that emphasizes stability, risk control, and formal processes across its organizational elements.

Analysis & Interpretation

Background

This McKinsey 7S Model examines how a traditional, hierarchical bank aligns its organizational elements to maintain stability, manage risk, and preserve customer trust. By reviewing the seven components—Strategy, Structure, Systems, Style, Shared Values, Staff, and Skills—this analysis highlights the strengths and constraints of a conservative banking environment navigating gradual digital transformation.

Key Strategic Insights

Strategy Centered on Stability and Trust: The bank prioritizes risk aversion, incremental digital adoption, and long-term customer relationships—favoring steady reliability over rapid innovation.

Structure Reinforces Control and Clear Hierarchy: Departmental silos and centralized decision-making maintain order and predictability but limit cross-functional collaboration and agility.

Systems Built for Consistency and Compliance: Layered approval processes, legacy IT infrastructure, and formal annual reviews ensure thoroughness and regulatory adherence, though they slow change and responsiveness.

Leadership Style Reflects Tradition and Authority: A command-and-control approach upholds discipline and structure, supported by formal communication protocols that emphasize professionalism.

Shared Values Emphasize Security and Conservatism: The organization is deeply rooted in protecting assets, preserving reputation, and upholding traditional financial practices.

Staff Characterized by Tenure and Specialization: Employees tend to stay long-term, gaining deep institutional experience but operating in narrowly defined roles with limited cross-training.

Skills Focused on Risk and Regulatory Mastery: Core competencies include compliance, quantitative analysis, and risk management—skills essential for operational stability in a heavily regulated sector.

Strategic Summary

The bank’s success is built on reliability, regulatory strength, and long-standing trust. However, its hierarchical structure and legacy systems limit speed and innovation. As digital expectations grow, the organization must balance tradition with modernization by improving cross-functional collaboration, updating technology, and empowering teams while maintaining its core values of security and stability.

How This Canvas Was Built

This example demonstrates how organizational assessment tools reveal the internal dynamics that drive stability in traditional financial institutions.

AI-Guided Organizational Breakdown

Each of the seven S’s was analyzed to show how the bank’s conservative strategy aligns with its structure, systems, and workforce capabilities.

Structured Model Visualization

The canvas visually organizes the bank’s operational characteristics, making it easier to understand how hierarchy, culture, and systems reinforce the institution’s stability-focused approach.

Alignment Integrity Review

A final review confirmed strong consistency across the 7S elements, highlighting how tradition and risk management shape every aspect of the organization—while also revealing areas where modernization may be constrained.

Redefine Your Organizational Balance

Import this McKinsey 7S Model canvas to explore modernization priorities, identify structural improvements, or map your own organization’s alignment.